Question 1. Give specimen of the following, with two entries in each-

(i) Purchase Book, (ii) Purchases Return Book.

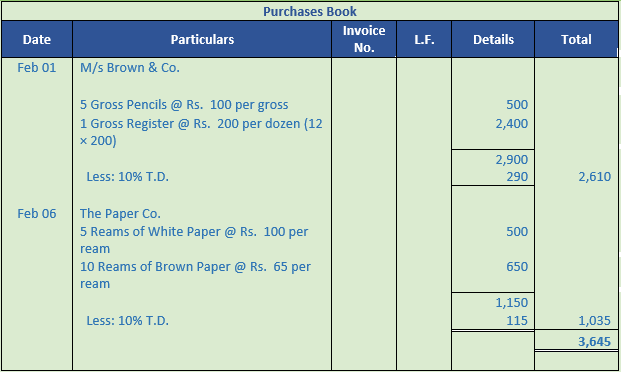

Solution 1: Purchases Book:- All the credit purchases of goods are recorded in the purchases book. This is a subsidiary book which records credit purchase of goods. Purchases Book also known as invoice book or purchases day book.

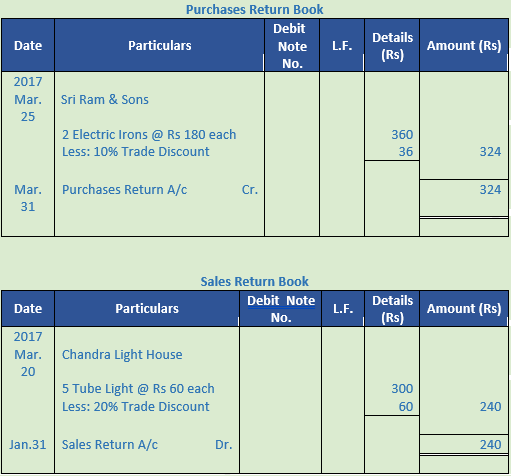

Purchases Return Book:- This book is used to recorded the return of such goods as work purchases on credit basis. This book is also known as return onward book.

Question 2. Explain Debit and Credit note in five sentences.

Solution 2: Debit note:- A debit note is prepared by the purchaser when goods are returned by him is called a debit note because the party’s account is debited with the amount written in it.

Credit note:- A credit note is prepared by the seller when the goods sold are received back. It is called a credit note because the party’s account, from whom goods are received back, is credited with the amount written in the note.

Question 3. Name the various entries which have to be passed through a journal through we might have kept all the subsidiary books in the business.

Solution 3: Below are the entries which have to be passed through a journal through we might have kept all the subsidiary books in the business:-

1.) Purchases of Fixed Assets on Credit i.e. Purchases of Machinery on credit basis.

2.) Making provisions for doubtful debts.

3.) Providing depreciation on assets.

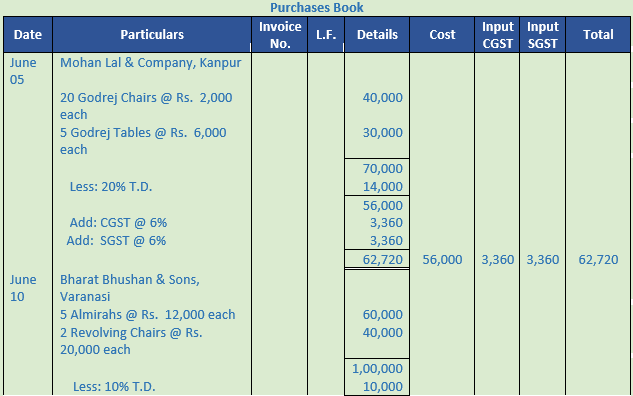

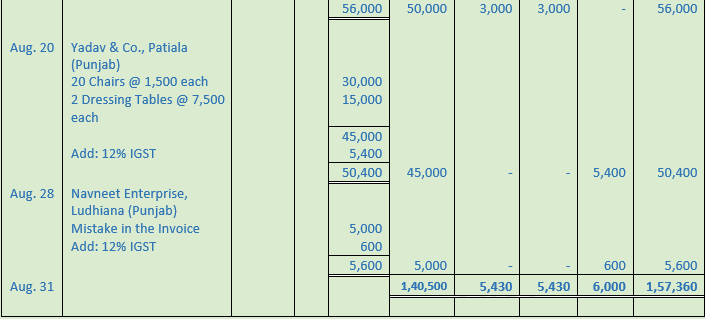

Question 1. Prepare a Purchase Book in the books of M/s Modern Furniture House, Lucknow (U.P) from the following transactions assuming CGST @ 6% and SGST @ 6% :-

2017

June 5

Bought from Mohan Lal & Co., Kanpur (U.P) :-

20 Godrej Chairs @ Rs. 2,000 each

5 Godrej Tables @ Rs. 6,000 each

Trade Discount 20%

10

Purchased from Bharat Bhushan & Sons, Varanasi (U.P) :-

5 Almirahs @ Rs. 12,000 each

2 Revolving Chairs @ Rs. 20,000 each

Trade Discount 10%

14

Purchased from Surya Traders, Lucknow (U.P)

80 Desks @ Rs. 2,500 each

10 Sofa Sets @ Rs. 20,000 each

Trade Discount @ 15%

20

Purchased for cash from Gopi Chand Haldi Ram, Delhi :-

4 Tables @ Rs. 5,000 each

25

Bought Furniture for office use from New Furniture House, Faridabad on Credit :

5 Chairs @ Rs. 2,500 per Chair.

2 Tables @ Rs. 5,000 per Table.

Solution 1:

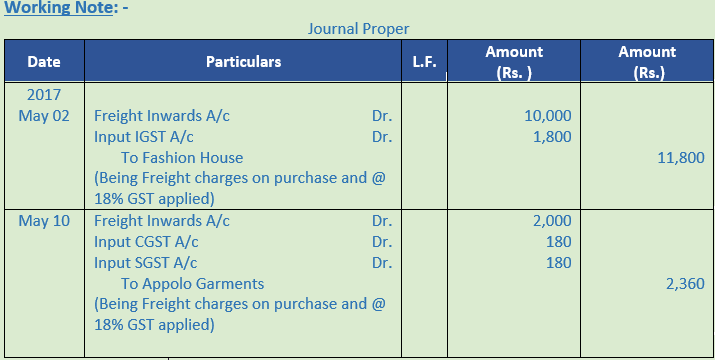

Working Note:-

- Price of a chair = Rs. 2,000

Price of 20 such chairs = Rs. 2,000 × 20 = Rs. 40,000

Price of a table = Rs. 6,000

Price of 5 such tables = Rs. 6,000 × 5 = Rs. 30,000

- Price of a Almirah = Rs. 12,000

Price of 5 such chairs = Rs. 12,000 × 5 = Rs. 60,000

Price of a Revolving chairs = Rs. 20,000

Price of 2 such tables = Rs. 20,000 × 2 = Rs. 40,000

Point of Knowledge:-

In Purchases Book, we record only the credit purchase of goods, so transaction dated June 20 (being cash purchase of goods) and June 25 (being credit purchase of Fixed Asset) will not be recorded.

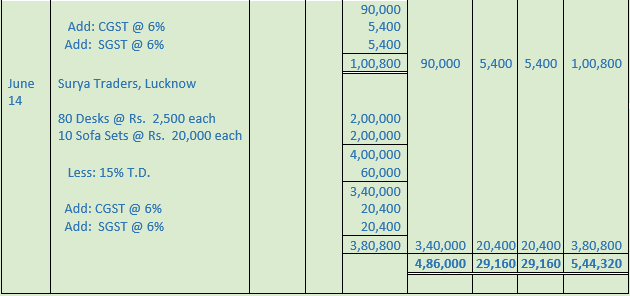

Question 2. M/s Ram Narain & Sons of Kerala, who are dealers in readymade garments, purchased the following :-

Solution 2:

Point of Knowledge:-

In Purchases Book, we record only the credit purchase of goods, so transaction dated May 15 (being purchase of Furniture on credit) and May 25 (being purchase of goods for cash) will not be recorded.

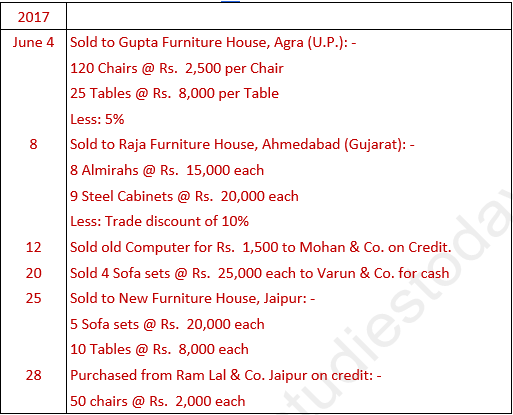

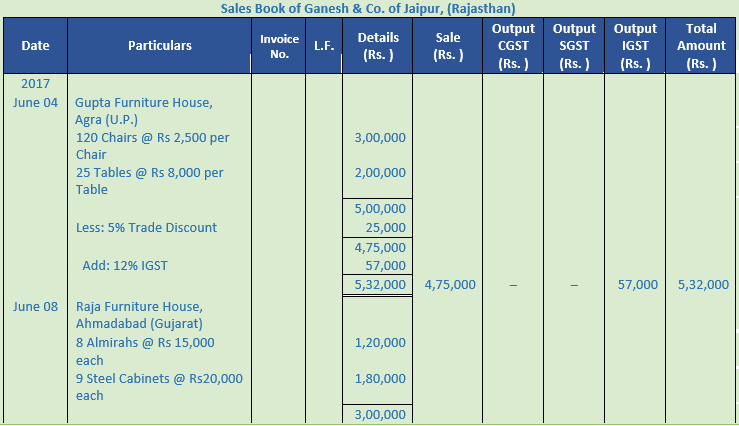

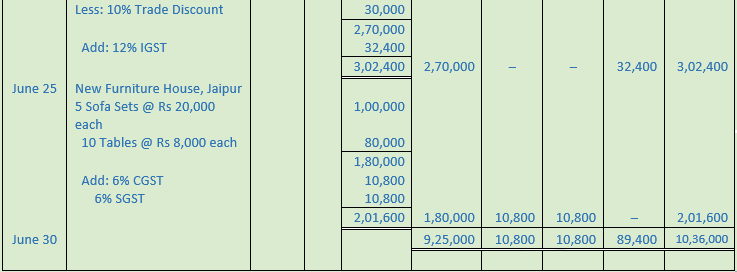

Question 3. Record the following transactions in the Sales Book of Ganesh & Co. of Jaipur (Rajasthan), who deal in Furniture. Assume CGST @ 6% and SGST @ 6% :-

Solution 3:

Working Note:-

- Price of a chair = Rs. 2,500

Price of 120 such chairs = Rs. 2,500 × 120 = Rs. 3,00,000

Price of a table = Rs. 8,000

Price of 25 such tables = Rs. 8,000 × 25 = Rs. 2,00,000

- Price of a Almirah = Rs. 15,000

Price of 8 such chairs = Rs. 15,000 × 8 = Rs. 1,20,000

Price of a Steel cabinet = Rs. 20,000

Price of 9 such tables = Rs. 20,000 × 9 = Rs. 1,80,000

Point of Knowledge:-

In Sales Book, we record only the credit sale of goods, so transaction dated June 12 (being Computer sold on credit) and June 20 (being Sofa Sets sold for cash) will not be recorded.

Question 4.

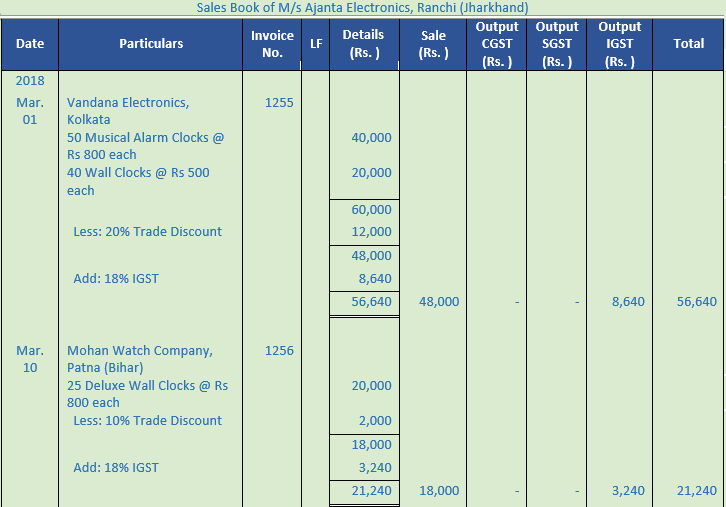

Record the following transactions in the Sales Book of M/s Ajanta Electronics, Ranchi (Jharkhand) assuming CGST @ 9% and SGST @ 9%:

2018

March 1

Sold to Vandana Electronics, Kolkata (West Bengal) Vide Invoice No. 1255:

50 Musical Alarm Clocks @ Rs. 800 each

40 Wall Clocks @ Rs. 500 each

Trade Discount 20%

10

Sold to Mohan Watch Company, Patna (Bihar) Vide Invoice No. 1256:

25 Deluxe Wall Clocks @ Rs. 800 each

Trade Discount 10%

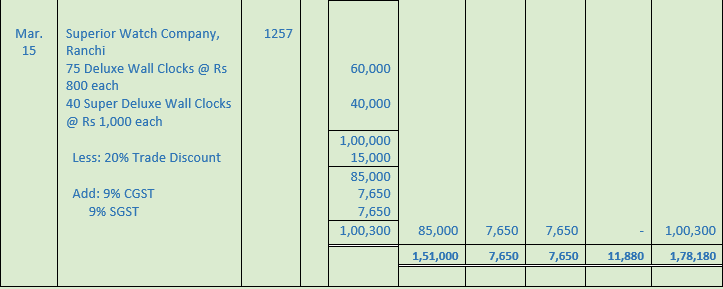

15

Sold to Superior Watch Company, Ranchi Vide Invoice No. 1257:

75 Deluxe Wall Clocks @ Rs. 800 each

40 Super Deluxe Wall Clocks @ Rs. 1,000 each

Trade Discount 15%

20

Sold to Modern Electronics, Ranchi Vide Cash Memo No. 5234:

100% Musical Alarm Clocks @ Rs. 800 each

Trade Discount 20%

Solution 4:

Working Note:-

- Price of a Musical Alarm Clock = Rs. 800

Price of 50 such Musical Alarm Clock = Rs. 800 × 50 = Rs. 40,000

Price of a Wallclock = Rs. 500

Price of 40 such Wallclock = Rs. 500 × 40 = Rs. 20,000

- Price of a Deluxe Wall Clocks = Rs. 800

Price of 75 such Deluxe Wall Clocks = Rs. 800 × 75 = Rs. 60,000

Price of a Super Deluxe Wall Clocks = Rs. 1,000

Price of 40 such tables = Rs. 1,000 × 40 = Rs. 40,000

Point of Knowledge:-

In the Sales Book we record only credit transactions related to goods, so transaction dated March 20 (being sale of electronics for cash) will not be recorded.

Question 5.

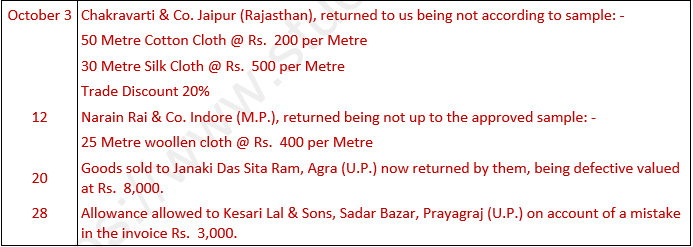

Write up Return Outward Book of Malthotra & Co., Bhiwani (Haryana) from the following transactions assuming CGST @ 6% and SGST @ 6% : –

Solution 5:

Point of Knowledge:-

The purchaser prepares a ‘Debit Note’ and sends it to the supplier. A Debit Note is prepared w en goods are returned by the purchaser due to some reason. It is called a Debit Note because the party’s account is debited with the amount written in this note. The ‘Debit Note’ is the basis for writing in the Purchases Return or Return Outward Book.

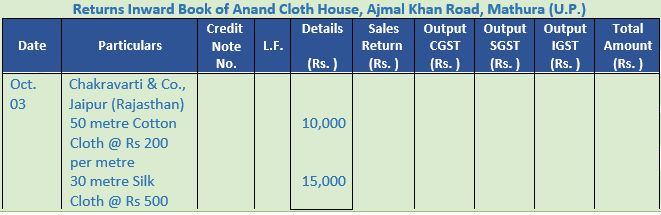

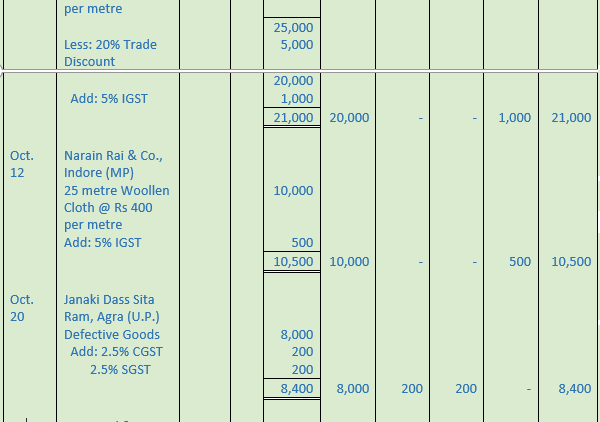

Question 6.

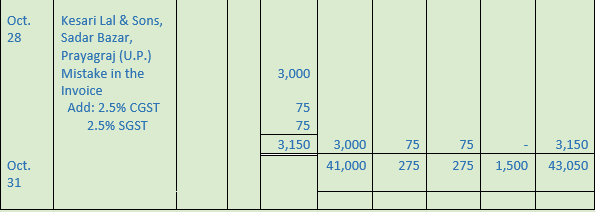

Enter the following transactions in the Returns Inward Book of Anand Cloth House, Ajmal Khan Road, Mathura (U.P.) assuming CGST @ 2.5% and SGST @ 2.5% :-

Solution 6:

Point of Knowledge:-

The reason for maintaining separate accounts for CGST, SGST and IGST are to setoff the GST Paid against the GST Collected in the prescribed order. GST paid or Input GST individually (Input CGST, SGST and IGST) is set off against GST Collected (Output GST) individually (Output CGST, SGST and IGST) in the prescribed order. Hence, it is necessary that separate accounts for Input GST and Output GST for each category of GST be maintained. It will enable the taxpayer to follow prescribed order of setting off the each category of GST.

Question 7.

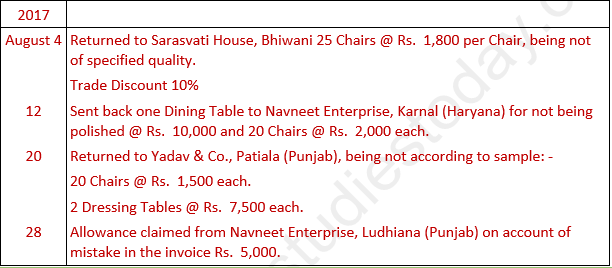

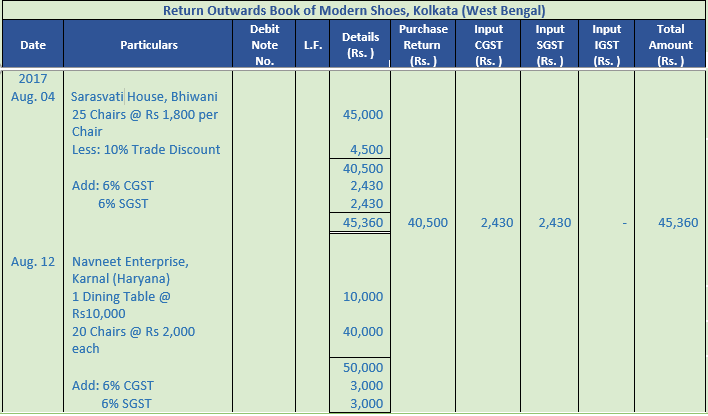

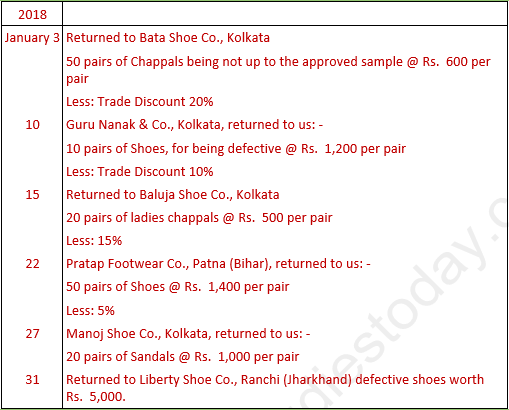

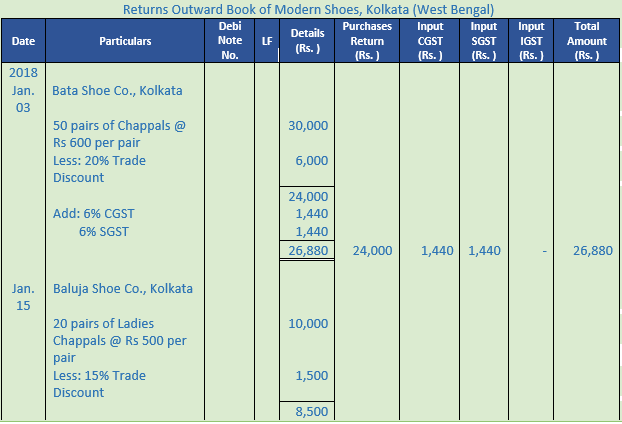

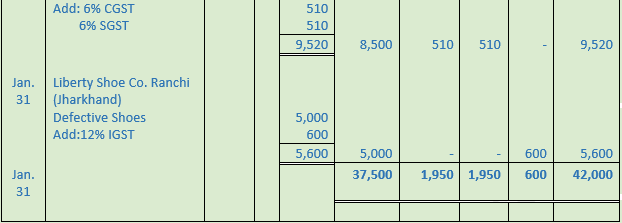

Prepare Returns Inward and Returns Outward Books from the following in the books of Modern Shoes, Kolkata (West Bengal) assuming CGST @ 6% and SGST @ 6% :-

Solution 7:

Point of Knowledge:-

Debit note:- A debit note is prepared by the purchaser when goods are returned by him is called a debit note because the party’s account is debited with the amount written in it.

Credit note:- A credit note is prepared by the seller when the goods sold are received back. It is called a credit note because the party’s account, from whom goods are received back, is credited with the amount written in the note.

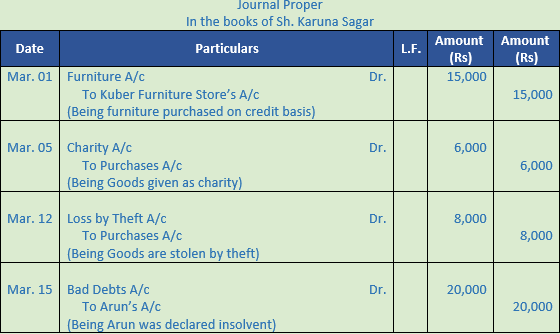

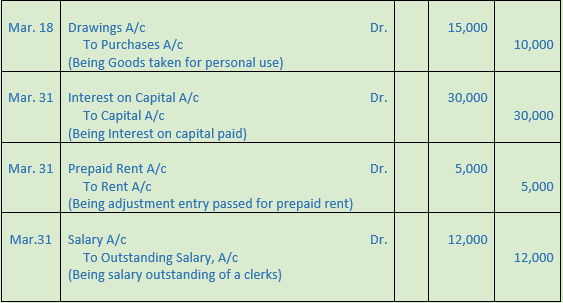

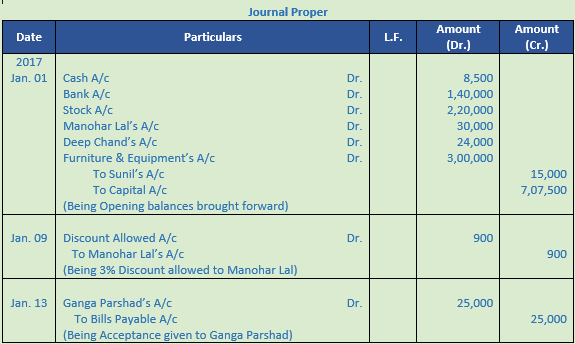

Question 8.

Enter the following transactions in the ‘Journal Proper’ of Karuna Stores :

March 1 Purchased furniture on credit from Kuber Furniture Store for Rs. 15,000.

March 5 Goods for Rs. 6,000 given away as charity.

March 12 Goods worth Rs. 8,000 and Cash Rs. 4,000 were stolen by an employee.

March 15 Arun who owed us Rs. 20,000 was declared insolvent and nothing was received from him.

March 18 Proprietor withdrew for his personal use cash Rs. 5,000 and goods worth Rs. 10,000.

March 31 Provide interest on capital of Rs. 5,00,000 at 6% p.a. for full year.

March 31 Out of the rent paid this year, Rs. 5,000 is related to the next year.

March 31 Salaries due to clerks Rs. 12,000.

Solution 8:

Point of Knowledge:-

Only credit transactions are recorded in the Journal Proper.

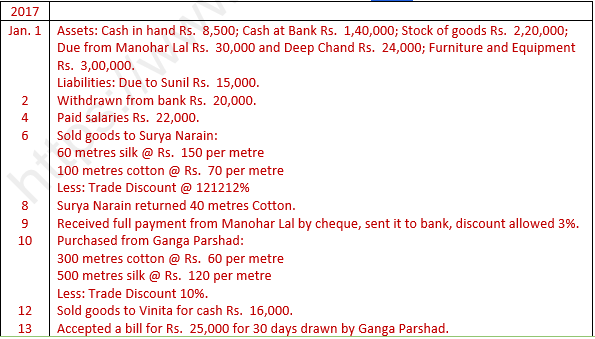

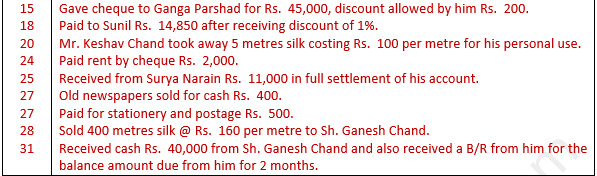

Question 9.

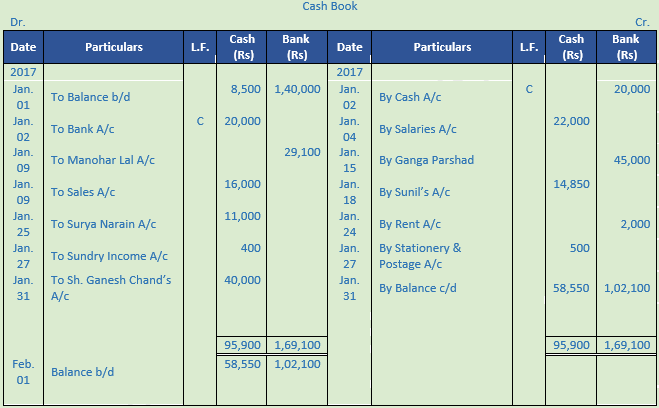

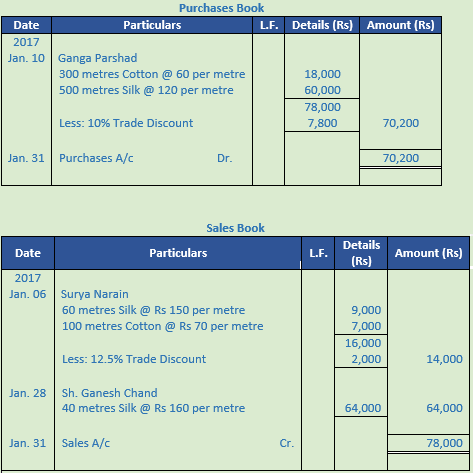

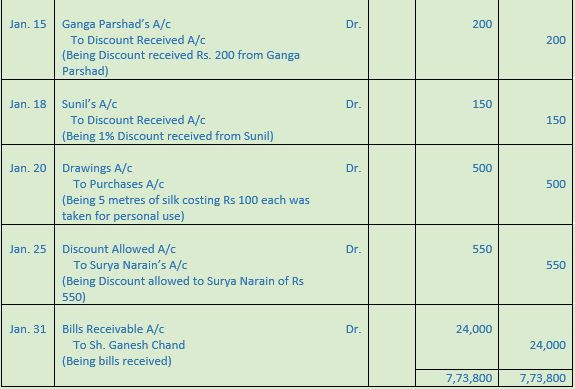

Record the following transactions of Keshav Bros. in the proper books :

Solution 9:

7,73,800

Point of Knowledge:-

Adjustment Entries are passed at the end of the year to adjust the amounts paid or received in advance or for amounts not yet settled in cash. Such an adjustment is also made through Journal entries. Usually the adjustment entries are made for outstanding expenses, prepaid expenses, interest on capital, depreciation, etc.

Question 10.

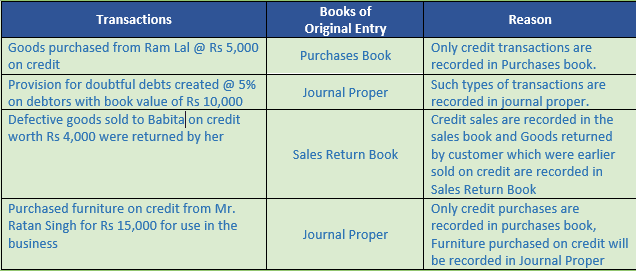

Name the books of original entry where the following transactions will be recorded with reasons there of:

(a) Goods Purchased from Ram Lal Rs. 5,000 on credit.

(b) Provision for doubtful debts created @ 5% on debtors with book value of Rs. 10,000.

(c) Defective goods sold to Babita on credit worth Rs. 4,000 were returned by her.

(d) Purchased furniture on credit from Mr. Ratan Singh for Rs. 15,000 for use in the business.

Solution 10:

Question 11.

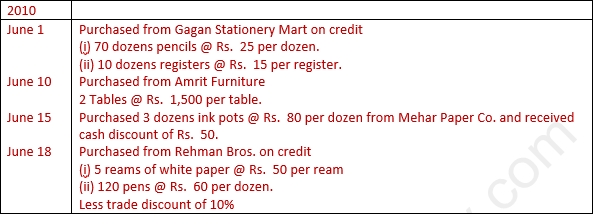

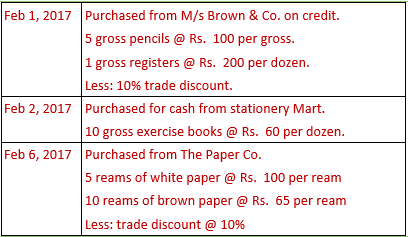

Prepare the purchase book of M/s Shiv Stationers from the following:

Solution 11:

Working Note:-

1dozen = 12units

120 pen will be = = 10 dozen

Price of 1 dozen pen = Rs. 60

Price of 10 dozen pen = Rs. 60 × 10 = Rs. 600

Point of Knowledge:-

Purchases book records only the credit purchase of goods, so transaction dated June 10 (being purchase of furniture) and June 15 (being purchase of goods for cash) will not be recorded.

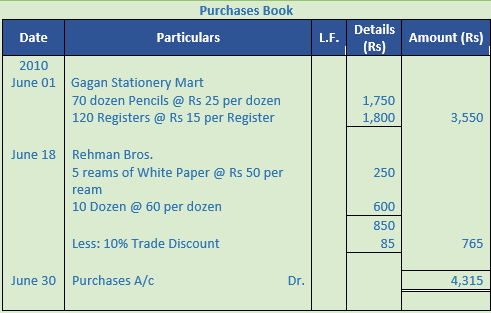

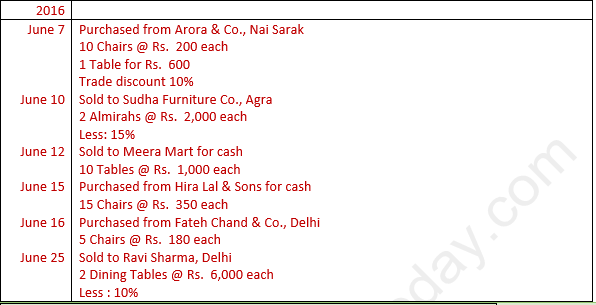

Question 12.

From the following particulars prepare the Purchases Book of Rama Book Store:

Solution 12:

Point of knowledge:-

Debit note:- A debit note is prepared by the purchaser when goods are returned by him is called a debit note because the party’s account is debited with the amount written in it.

Credit note:- A credit note is prepared by the seller when the goods sold are received back. It is called a credit note because the party’s account, from whom goods are received back, is credited with the amount written in the note.

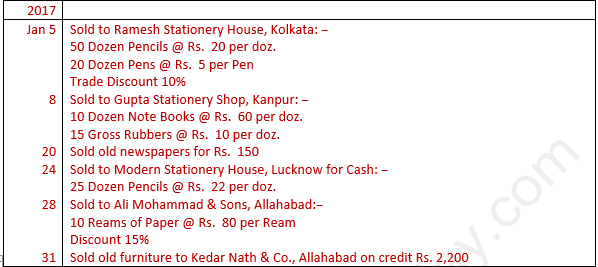

Question 13.

Enter the following transactions in the Sales Book of M/s Sri Ram & Sons, Kolkata:−

Solution 13:

Point of Knowledge:-

Sales book records only the credit sale of goods, so transaction dated Jan. 20, Jan. 24 and Jan. 31 will not be recorded.

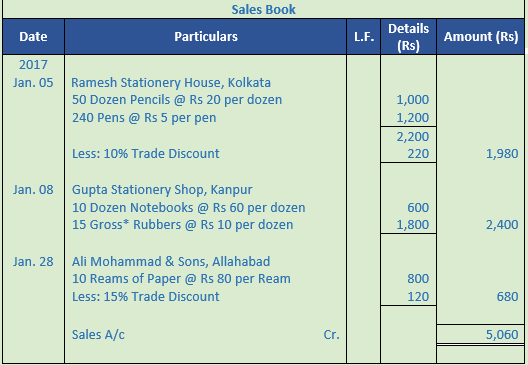

Question 14.

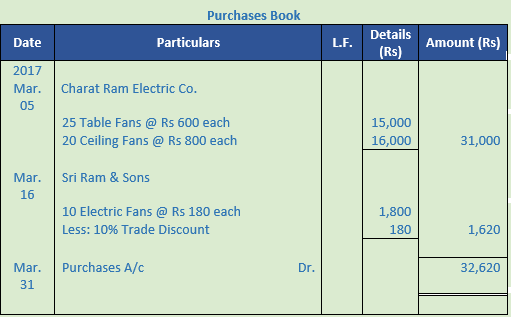

Prepare Sales book and Purchases book of M/s Deendayal from the following transactions:−

Solution 14:

Point of Knowledge:-

Debit note:- A debit note is prepared by the purchaser when goods are returned by him is called a debit note because the party’s account is debited with the amount written in it.

Credit note:- A credit note is prepared by the seller when the goods sold are received back. It is called a credit note because the party’s account, from whom goods are received back, is credited with the amount written in the note.

Question 15.

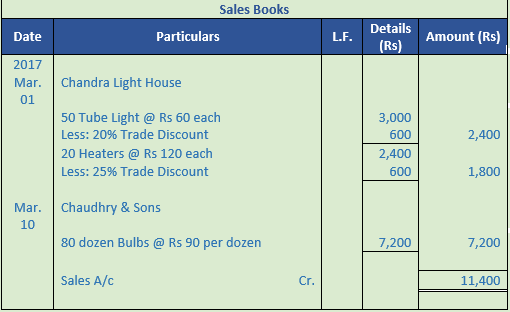

Following transactions were recorded in the books of Darshan Traders:−

You are required to prepare (i) Purchase Book; (ii) Sales Book; (iii) Purchase Return Book, and (iv) Sales Return Book.

Solution 15:

Point of Knowledge:-

Purchases Book is a subsidiary book in which credit purchases of goods dealt in or stores and raw material used for production are recorded.

Sales Book is a subsidiary book in which credit sales of goods dealt in are recorded.

Journal Proper is a book of account in which those transactions and events are recorded which are not recorded in the subsidiary books.

Question 16.

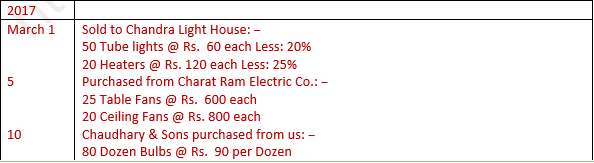

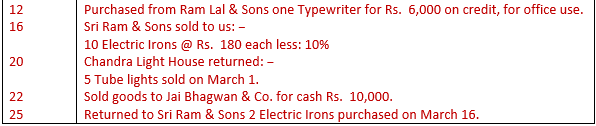

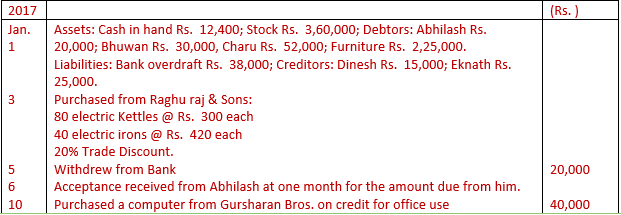

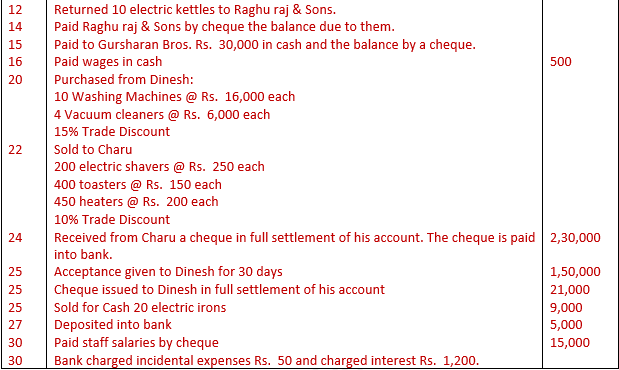

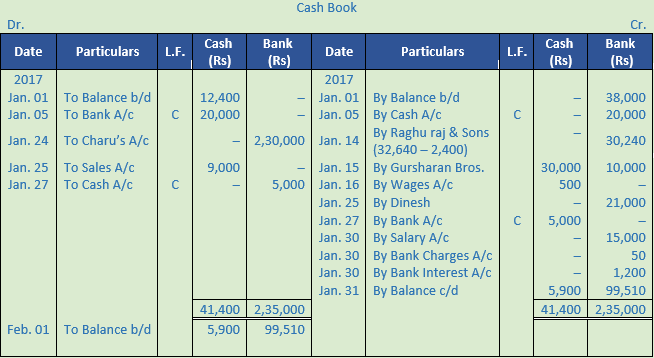

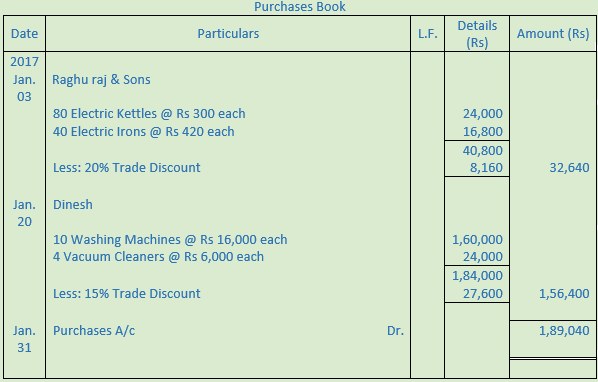

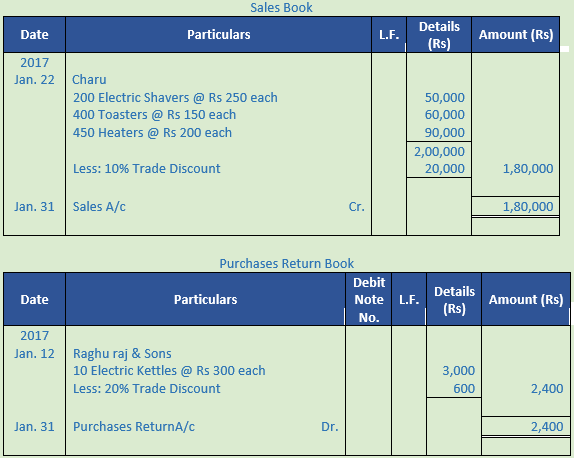

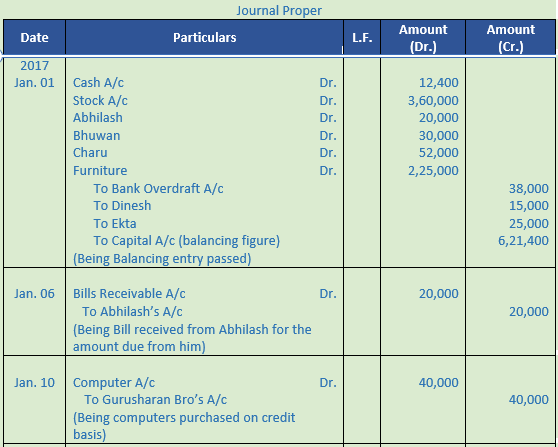

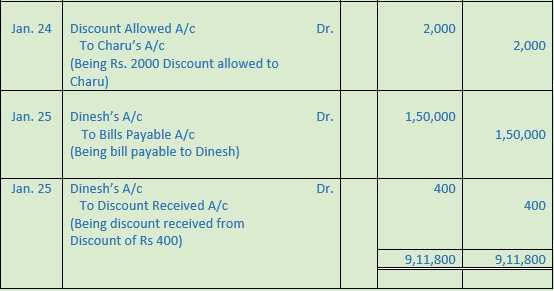

Enter the following transactions of a dealer in electrical goods in the appropriate subsidiary books:

Solution 16:

Point of knowledge:-

Purchases Book is a subsidiary book in which credit purchases of goods dealt in or stores and raw material used for production are recorded.

Sales Book is a subsidiary book in which credit sales of goods dealt in are recorded.

Journal Proper is a book of account in which those transactions and events are recorded which are not recorded in the subsidiary books.