Short Answer Question

Question 1. What is GST?

Solution 1: Goods and services tax (GST) is a tax imposed indirectly on the goods and services supply.

Question 2. Name the two central taxes that have merged into GST.

Solution 2: The two central taxes that have merged into GST are:-

(i) Custom duty

(ii) Excise duty

Question 3. Name the two-state taxes that have merged into GST.

Solution 3: The two central taxes that have merged into GST are:-

(i) VAT

(ii) Purchase Tax

Question 4. Give two advantages of GST.

Solution 4: The two advantages of GST are :-

(i) GST reduce the sales without receipts and corruption.

(ii) GST reduce multiple tax evasion.

Question 5. What is the full form of CGST?

Solution 5: CGST refers to Central Goods and Services Tax.

Question 6. What is the full form of SGST?

Solution 6: SGST refers to State Goods and Services Tax.

Question 7. What is the full form of IGST?

Solution 7: IGST refers to Integrated Goods and Services Tax.

Question 8. What is CGST?

Solution 8: CGST refers to Integrated Goods and Service Tax. It is levied on intra-state or within state sales. The CGST is supervised by the central government and administered by the CGST Act. Example: A dealer of Rajasthan sells goods to a dealer of Rajasthan worth Rs. 50,000. Suppose the CGST and SGST rate is 12%. In the case the seller will charge 6% of CGST and 6% of SGST Rs. 3,000 as CGST and Rs. 3,000 as SGST.

Question 9. What is IGST?

Solution 9: IGST refers to Integrated Goods and Service Tax. It is levied on inter-state sales. The IGST is supervised by the IGST act. For Example: A dealer of Rajasthan sells goods to a dealer in Uttar Pradesh worth Rs. 50,000. Suppose the IGST rate is 12%. In the case the seller will charge Rs. 6,000 as IGST.

Practical Question

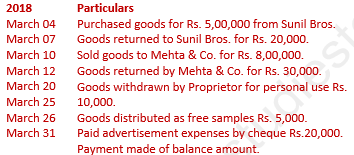

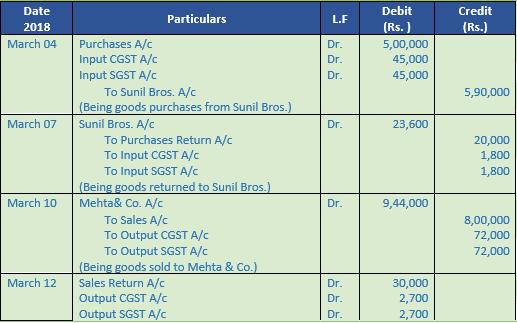

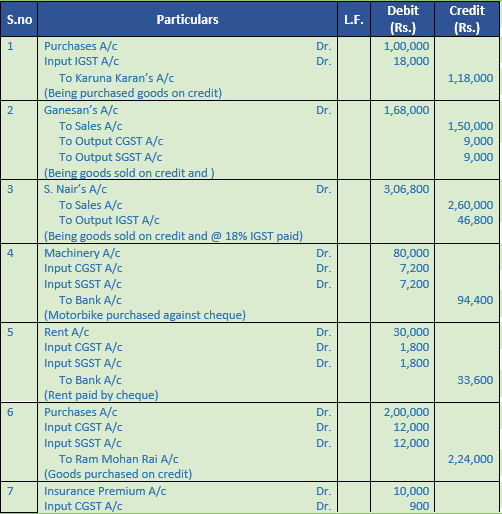

Question 1. Pass entries in the books of Mukherjee & Sons. assuming all transactions have taken place within the state of Uttar Pradesh. Assume CGST @9% and SGST @ 9%.

Solution 1:

Point of Knowledge:-

The cost of goods will decrease since tax on tax is eliminated in GST regime. In the pre-GST regime, there were many indirect taxes levied by both centre and state. For example, Centre charged excise duty on goods manufactured and State charged VAT on the same goods. This lead to a tax on tax also known as cascading effect of taxes. GST avoid this cascading effect of taxes. GST avoids this casing effect as the tax is calculated only on the value added at each stage of transfer of ownership.

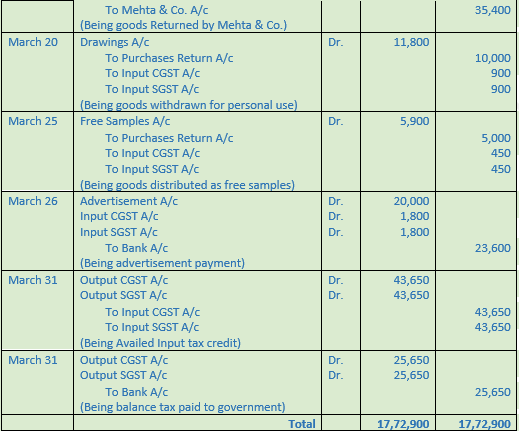

Question 2. Pass entries in the books of Devdhar & Bros. Odisha, assuming all transactions have been entered within the state, charging CGST and SGST @ 9% each.

Solution 2 :

Point of Knowledge:-

GST Rate Structure:- Goods and Service are divided into five slabs for collection of GST:

Essential items including food 0%

Common Use Items 5%

Standard Rate 12%

Maximum Goods and all services Standard Rate 18%

Luxury items and tobacoo 28%

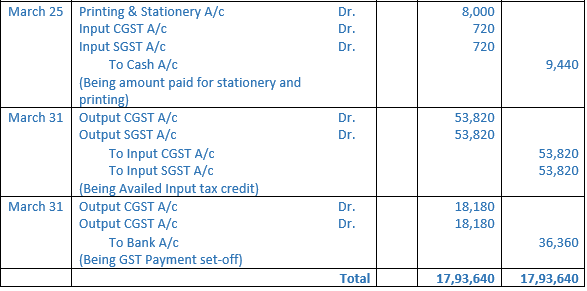

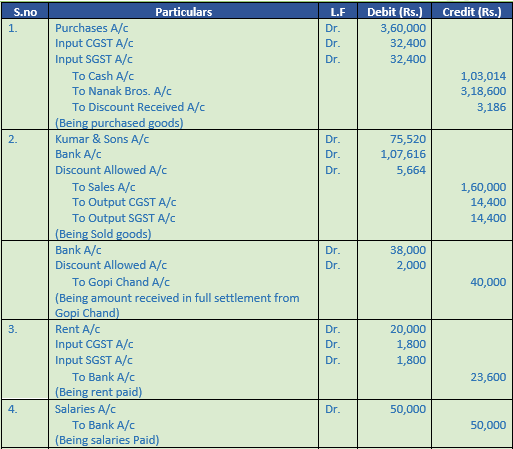

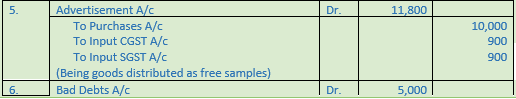

Question 3. Record the following transactions in the books of Sahdev & Sons assuming all transactions have been entered within the state of Bihar, Charging CGST and SGST @ 9% each.

Particulars

- Bought goods from Nanak Bros. for Rs. 4,00,000 at 10% trade discount and 3% cash discount on the purchase price. 25% of the amount paid at the time of purchase.

- Sold goods to Kumar & Sons. for Rs. 2,00,000 at 20% trade discount and 5% cash discount on sale price. 60% of the amount received by Cheque.

- Received from Gopi Chand Rs. 38,000 by Cheque after deducting 5% cash discount.

- Paid Rs. 20,000 for rent by Cheque.

- Paid Rs. 50,000 for salaries by Cheque.

- Goods worth Rs. 10,000 distributed as free samples.

- Rs. 5,000 due from Chanderkant are bad-debts.

- Sold household furniture for Rs. 15,000 and the proceeds were invested into business.

Solution 3:

Point of Knowledge:-

CGST refers to Integrated Goods and Service Tax. It is levied on intra-state or within state sales. The CGST is supervised by the central government and administered by the CGST Act. Example: A dealer of Rajasthan sells goods to a dealer of Rajasthan worth Rs. 50,000. Suppose the CGST and SGST rate is 12%. In the case the seller will charge 6% of CGST and 6% of SGST Rs. 3,000 as CGST and Rs. 3,000 as SGST.

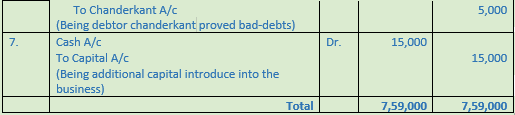

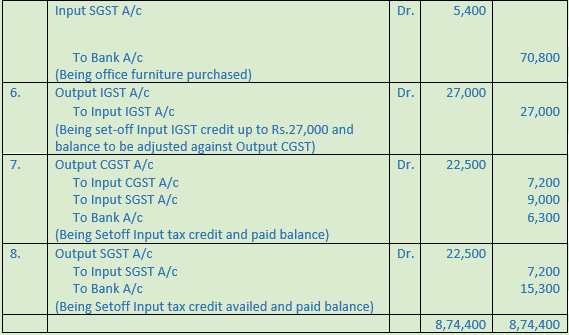

Question 4. Pass entries in the books of Mr. Roopani of Gujarat assuming CGST @ 9% and SGST@ 9%.

Particulars

- Purchased goods for Rs. 2,00,000 from Suryakant of Jaipur (Rajasthan) on Credit.

- Sold goods for Rs. 1,50,000 to Mr. Pawar of Mumbai (Maharashtra) and the cheque received was sent to bank.

- Sold goods for Rs. 2,50,000 within the state on credit.

- Paid insurance premium of 20,000 by cheque.

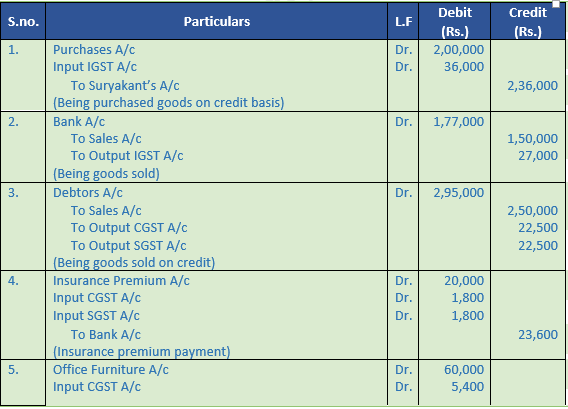

- Purchased furniture for office for Rs. 60,000 by cheque.

- Payment made of balance amount of GST.

Solution 4:

Working Note:-

Calculation of GST

IGST outstanding = Output IGST – Input IGST

= Rs. 27,000 – Rs. 36,000

= (Rs. 9,000)

Output CGST can set-off by both Input CGST and Input IGST

CGST outstanding = Output CGST – Input IGST – Input CGST

= Rs. 22,500 – Rs. 9,000 – Rs. 7,200

= Rs. 6,300

SGST outstanding = Output SGST – Input SGST

= Rs. 22,500 – Rs. 7,200

= Rs. 15,300

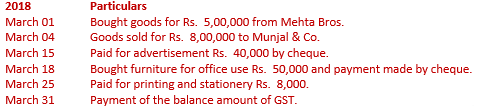

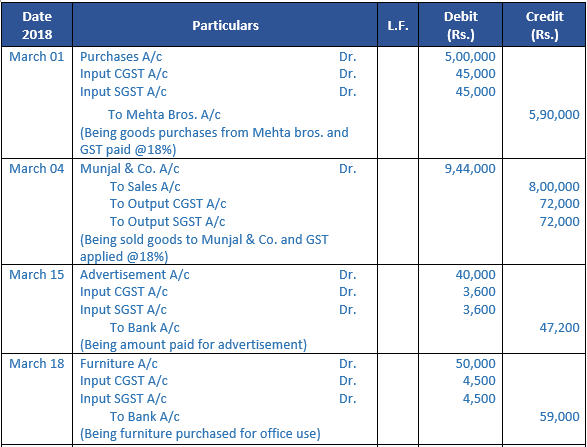

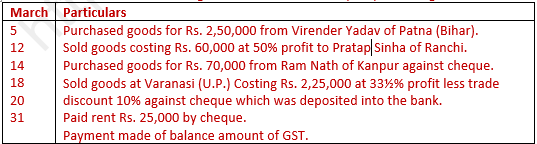

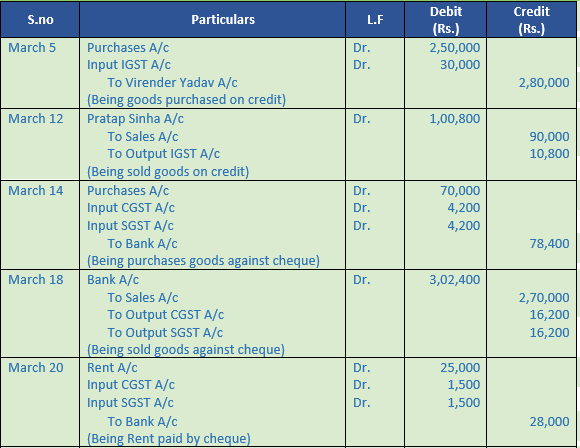

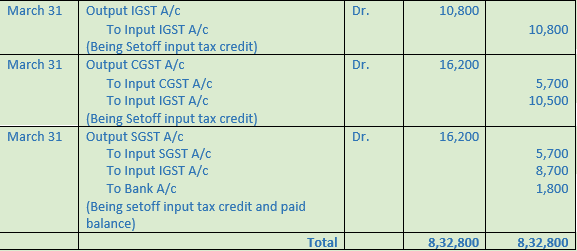

Question 5. Pass entries in the books of Sh. Jagdish Mishra of Lucknow (U.P.) assuming CGST @ 6% and SGST @ 6%.

Solution 5:

Point of Knowledge:-

SGST refers to Integrated Goods and Service Tax. It is levied on intra-state or within state sales. The SGST is supervised by the state government and administered by the SGST Act. Example: A dealer of Rajasthan sells goods to a dealer of Rajasthan worth Rs. 50,000. Suppose the CGST and SGST rate is 12%. In the case the seller will charge 6% of CGST and 6% of SGST Rs. 3,000 as CGST and Rs. 3,000 as SGST.

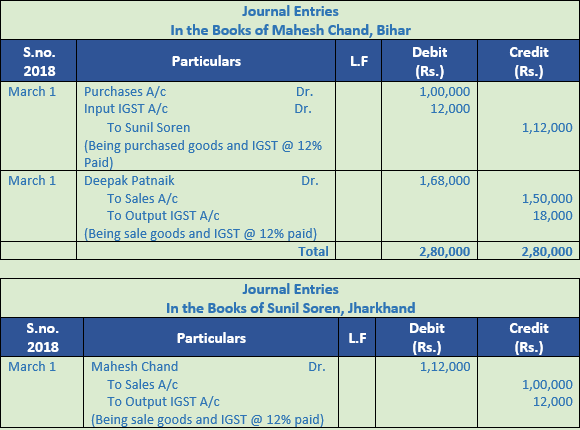

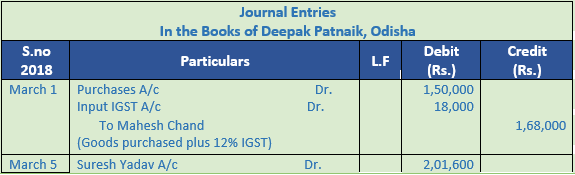

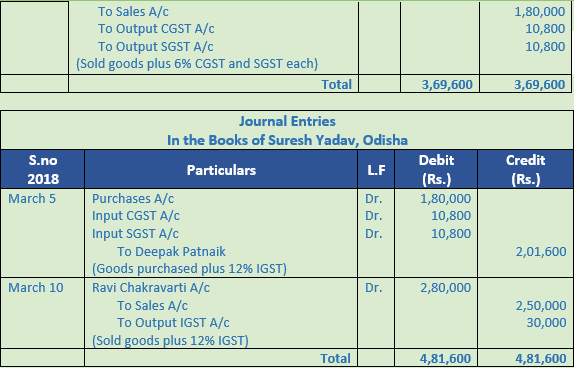

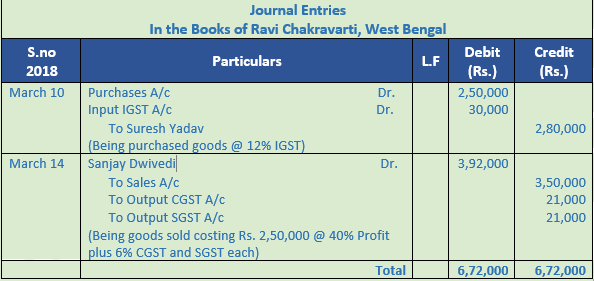

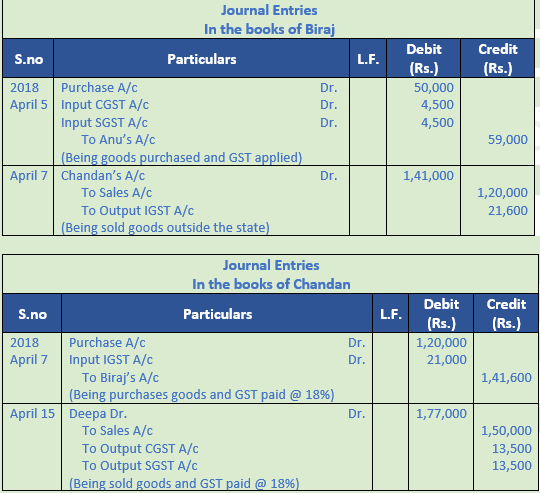

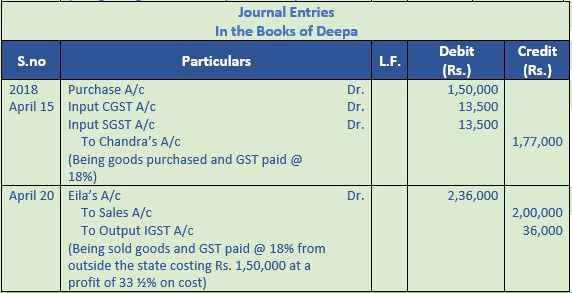

Question 6. Pass entries in the books of all parties in the following cases assuming CGST @ 6% and SGST @ 6%.

Solution 6:

Point of Knowledge:-

GST Rate Structure:- Goods and Service are divided into five slabs for collection of GST:

Essential items including food 0%

Common Use Items 5%

Standard Rate 12%

Maximum Goods and all services Standard Rate 18%

Luxury items and tobacco 28%

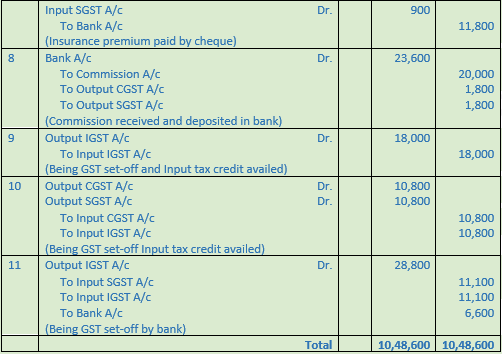

Question 7. Pass entries in the books of Krishnan of Bengaluru (Karnataka) in the following cases:

Particulars

- Purchased goods from Karunakaran of Chennai for Rs. 1,00,000. (IGST @18%)

- Sold goods to Ganeshan of Bengaluru for Rs. 1,50,000. (CGST @ 6% and SGST @ 6%)

- Sold goods to S. Nair of Kerala for Rs. 2,60,000. (IGST @18%)

- Purchased a Machinery for Rs. 80,000 from Surya Ltd. against cheque. (CGST @ 9% and SGST @ 9%)

- Paid rent Rs. 30,000 by cheque. (CGST @ 6% and SGST @ 6%)

- Purchased goods from Ram Mohan Rai of Bengaluru for Rs. 2,00,000. (CGST @ 6% and SGST @ 6%)

- Paid insurance premium Rs. 10,000 by cheque. (CGST @ 9% and SGST @ 9%)

- Received commission Rs. 20,000 by cheque which is deposited into bank. (CGST @ 9% and SGST @ 9%)

- Payment made of balance amount of GST

Solution 7:

Point of Knowledge:-

IGST refers to Integrated Goods and Service Tax. It is levied on inter-state sales. The IGST is supervised by the IGST act. For Example: A dealer of Rajasthan sells goods to a dealer in Uttar Pradesh worth Rs. 50,000. Suppose the IGST rate is 12%. In the case the seller will charge Rs. 6,000 as IGST.

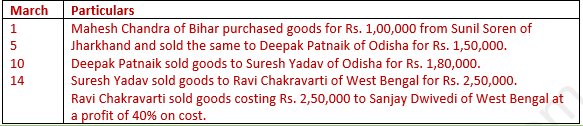

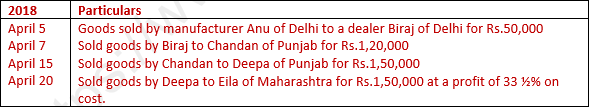

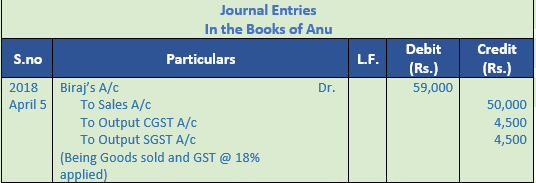

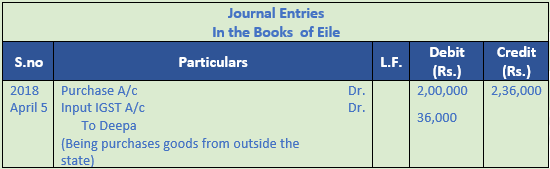

Question 8. Prepare a book for all the parties mentioned below assuming CGST and SGST 9% each.

Solution 8:

Point of Knowledge:-

GST is paid on purchase of goods and services and it is collected from customers on sale if goods and services. GST Paid (termed as Input GST) is set off against GST Collected (termed as output GST).

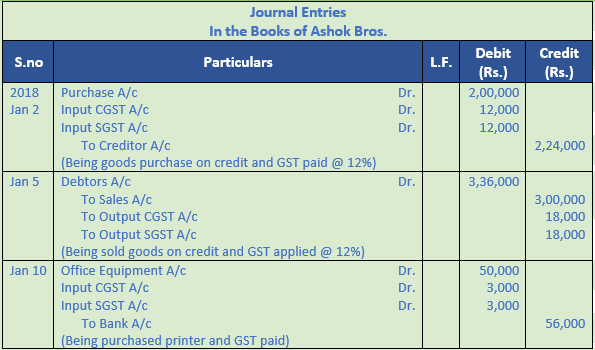

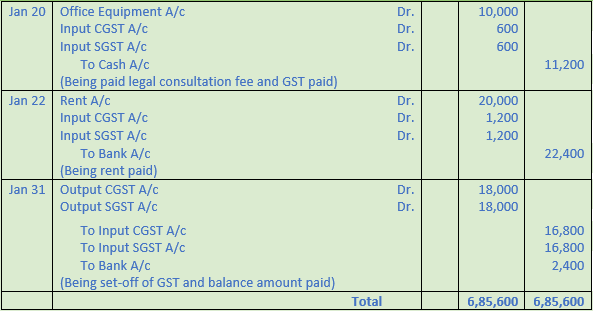

Question 9. Pass entries in the books of Ashok Bros. assuming that all transactions have been entered within Delhi and assuming CGST @6% and SGST @ 6%.

Solution 9:

Working Note:-

Calculation of GST Outstanding:-

Output CGST can set-off by both Input CGST and Input IGST

CGST outstanding = Output CGST – Input CGST

= Rs. 18,000 – Rs. 12,000 – Rs. 3,000 – Rs. 600 – Rs. 1,200

= Rs. 18,000 – Rs. 16,800

= Rs. 1,200

Output SGST can set-off by both Input SGST and Input IGST

CGST outstanding = Output SGST – Input SGST

= Rs. 18,000 – Rs. 12,000 – Rs. 3,000 – Rs. 600 – Rs. 1,200

= Rs. 18,000 – Rs. 16,800

= Rs. 1,200

Total Amount paid by bank for GST = Rs. 1,200 + Rs. 1,200 = Rs. 2,400